The principal document governing the affairs of a Partnership Firm or a LLP (collectively referred to as “Firm”) is the Partnership Deed or a LLP Agreement (collectively referred to as “Deed”). It is critical that the understanding of the Partners is clearly captured in the Deed. Partners incorporate a Firm, with a certain commercial agreement in mind. Such commercial agreement may include aspects such as, manner of distribution of profits and losses, the manner in which new Partners will be inducted in the Firm, the manner in which a Partner can be removed from the Firm and manner of dissolution of Firm.

Partners need to decide on the aforesaid aspects while drafting the Deed and ensure that such Deed reflects their commercial agreement. This is important because the Partnership Act, 1932 and the LLP Act, 2008 both specify instances, wherein in the absence of a written agreement between the Partners, the provisions of the relevant act will apply. The provision of the acts may not reflect the commercial understanding of the Partners which may lead to difficulties and problems later.

In this article we highlight certain key clauses that must be captured in a Deed and the points to consider while drafting such clauses.

- DISTRIBUTION OF PROFITS AND LOSSES

In some cases, the commercial agreement may be such that, certain Partners would be entitled to a larger share in the firm’s profits due to their initial contribution or their overall contribution in business of the Firm. While in some cases, certain Partners would be required to bear lesser losses compared to the other Partners, this may be due to their non-participation in the management of the Firm or their role being limited to bringing in initial capital or assets to the Firm.

In the absence of any written agreement between the Partners, the profits of a Firm will be equally distributed between the Partners and the Partners will contribute equally to the losses sustained by the Firm[1].

Drafting Points

Clause should clearly identify the Partners, the percentage of the profit share that each Partner will be entitled to, the amount of a Partners contribution towards losses sustained by the Firm and the timing and manner of making of such payments.

- ADMISSION OF NEW PARTNERS

A Firm is incorporated by Partners who share a common vision and have agreed upon commercial terms in relation to the Firm and its business. Naturally, admission of a new Partner is a critical aspect. The incoming Partner needs to be aligned with the objectives and vision of the Firm and the existing Partners. In most cases all Partners would prefer having a right to accept or deny the admission of a new Partner into the Firm. However, in some cases, the intention of the Partners may be to grant only few Partners the right to admit a new Partner. In such cases, careful consideration is required in drafting clauses pertaining to admission of a new Partner.

In the absence of any written agreement between the Partners, the consent of all existing Partners of the Firm will be required to admit a new Partner into the Firm[2].

Drafting Points

Clause should clearly identify the Partners who would have a right to admit new Partners in the Firm and it should be stated that only such Partners would be entitled to introduce new Partners in the Firm. Any eligibility criteria required to be fulfilled by any incoming Partners can be included.

- RETIREMENT OF PARTNERS

Partners play an important role in the overall performance and business of a Firm. In many cases, roles and responsibilities of the Firm would be divided between Partners. Accordingly, careful consideration is required in determining the manner in which Partners can retire from the Firm. In order to ensure smooth transition of business it is important that proper planning and reallocation of responsibilities is completed. Partners should keep in mind the time that would be required for such planning and reallocation and appropriate duration of notice should be mentioned in the Deed.

In the absence of any written agreement between the Partners, in the case of a Partnership Firm, the consent of all Partners is required for a Partner to retire. In case of a Partnership at Will[3] a Partner is permitted to retire after providing a written notice to the other Partners[4]. In case of a LLP, a Partner is permitted to retire by providing a written notice of thirty days to other Partners.

Drafting Points

Clause should clearly set out the manner of retirement of a Partner. In cases where approval of specific Partners is required for a Partner to retire – such Partners should be clearly identified. Clause should specifically state that the retirement notice shall be in writing and addressed to relevant Partners, address wherein such notices are to be served should be set out in the Notices clause. If required, a specific hand-over clause should be inserted which would include an obligation on any retiring Partner to complete handover of responsibilities, documents and confidential information in a specified manner.

- EXPULSION OF A PARTNER

The constitution of a Firm may be such, wherein certain Partners have superior rights as compared to other Partners. It may be the intention of the Partners that majority of Partners should have the right to expel a Partner from the Firm if a Partner is negligent in fulfilling his duties, or in case of disputes with such Partner.

In the absence of any written agreement between the Partners, majority Partners cannot simply expel a Partner from the Firm[5].

Drafting Points

Clause should state that a Partner may be expelled by a majority of the existing Partners. Specific grounds on which such expulsion can be triggered should be stated. Clause should set out the procedure to be followed for such expulsion, such procedure should include manner of serving notice, requirement to pass a resolution by majority of the Partners, time frame within which such expulsion will be effective and any procedure of appeal if required.

- DISSOLUTION OF FIRM

A Firm is incorporated by Partners to achieve a common business objective. A large amount of effort, time and resources are spent by the Partners to set up and operate the Firm. In such cases it is necessary to ensure continuity of the Firm. An event which may not be in the control of other Partners may lead to dissolution of the Firm. As per the Indian Partnership Act, 1932, unless otherwise agreed in writing by the Partners, death or insolvency of one partner will lead to dissolution of the Firm. If the intent of the Partners is that, death or insolvency of one of the Partners should not impair the continuity of the Firm, such intent needs to be clearly captured in the Deed.

A LLP’s continuity is however, not affected by the death of a Partner. A LLP may be wound up voluntarily by the Partners by passing a resolution to that effect with 3/4th majority.

Drafting Points

Clause should state that death, lunacy or insolvency of one Partner will not lead to dissolution of the Firm. Relevant clause of the Deed may empower majority of Partners to expel an insolvent or unfit Partner. Manner of distribution of the outgoing Partner’s share from the Firm should be set out.

- CONVERSION OF A PARTNERSHIP FIRM INTO LLP

A Partnership Firm may be converted into a LLP. All Partners of a Partnership Firm are required to be Partners in the LLP. Upon conversion of the Firm into a LLP, all tangible (movable and immovable) property as well as intangible property, all assets, agreements, rights, privileges, liabilities, obligations relating to the Partnership Firm shall be transferred to the LLP.

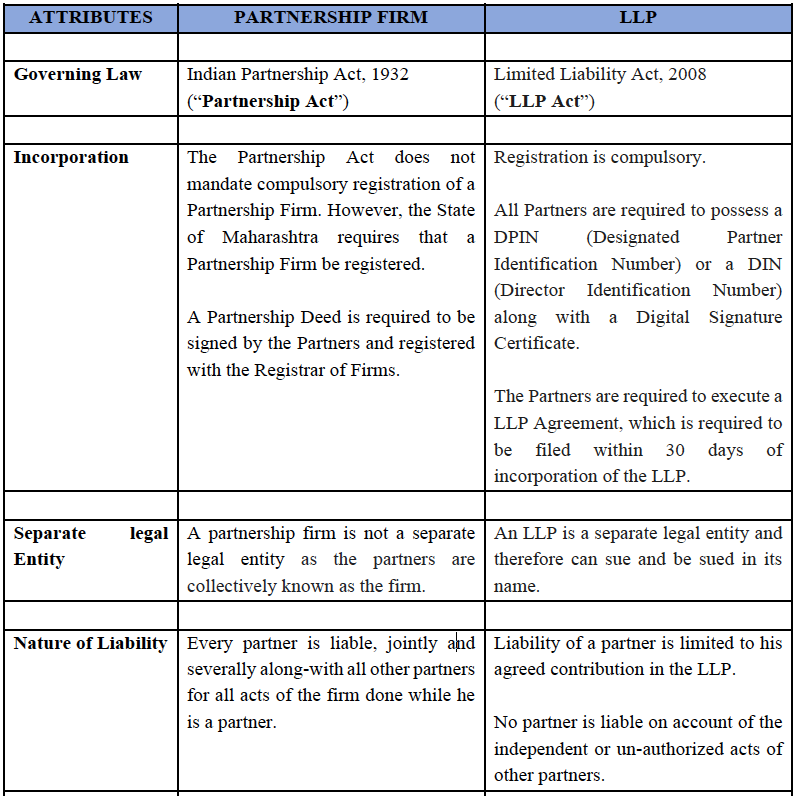

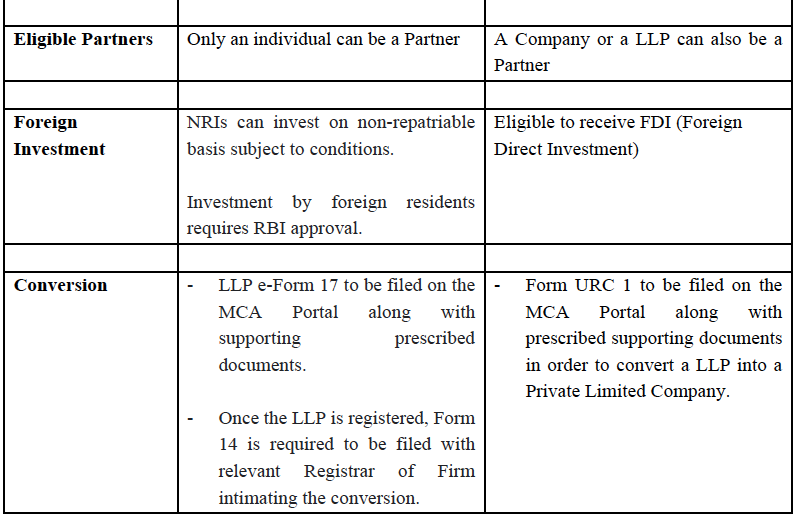

7. KEY ATTRIBUTES OF PARTNERSHIP FIRM AND A LLP

In addition to the above points, in order to provide a holistic view, we have set out certain key attributes of a Partnership Firm and a Limited Liability Partnership.

For more information about Partnership Firms and LLPs you may write to us at

solutions@bridgeheadlaw.com.

– Karan Narvekar | Partner

– Pratiksha Thipsay | Legal Trainee

Views expressed are personal to the authors and do not constitute as legal advice.

[1] Section 13 (b) of the Indian Partnership Act, 1932 and Schedule 1 of the Limited Liability Partnership Act, 2008

[2] Section 31 of the Indian Partnership Act, 1932 and Schedule 1 of the Limited Liability Partnership Act, 2008.

[3] Section 5 of the Indian Partnership Act, 1932 states that, “Where no provision is made by contract between the partners for the duration of their partnership, or for the determination of their partnership, the partnership is “partnership-at-will””.

[4] Section 32 of the Indian Partnership Act, 1932.

[5] Section 33 of the Indian Partnership Act, 1932 and Schedule 1 of the Limited Liability Act, 2008