Recovery of dues is a common pain point for all organizations. One benefit of obtaining a MSME registration is the availability of an additional and effective recovery mechanism under the Micro, Small And Medium Enterprises Development Act, 2006 (“MSME Act”). A registered Micro or Small entity can utilize the MSME Samadhaan portal created by the Ministry of MSMEs whereby such registered entities can file complaints online.

Micro, Small and Medium Enterprises (MSMEs) play a vital role in the economy. As per the MSME Annual Report 20-21, in 2018-2019, MSMEs contributed 30.27 % to the Gross Domestic Product of India and during the period 2015-16, there were 633.88 lakh unincorporated non-agriculture MSMEs in the country engaged in different economic activities. The MSME Samadhaan portal is symbolic of the steps taken by the Government to protect MSMEs and encourage their growth.

Who can register as a MSME?

As per the MSME Act, any type of entity such as a Company, Partnership Firm, Sole Proprietorship, LLP, One Person Company, Hindu Undivided Family can obtain a MSME registration.

Classification of a MSME:

| Micro | Investment in Plant and Machinery or Equipment does not exceed Rupees One Crore and turnover does not exceed Rupees Five Crores. |

| Small | Investment in Plant and Machinery or Equipment does not exceed Rupees Ten Crores and turnover does not exceed Rupees Fifty Crores. |

| Medium | Investment in Plant and Machinery or Equipment does not exceed Rupees Fifty Crores and turnover does not exceed Rupees Two Hundred and Fifty Crores. |

Recovery Process for Micro and Small Enterprises

| Trigger | A buyer / service receiver, fails to make payment of dues in the period agreed between the parties in writing. In case no such period is agreed upon, payment is required to be made in 45 days of purchasing the goods/ obtaining the services. |

| Penal Interest

|

A buyer / service receiver, is liable to pay compound interest on the delayed payments at the rate which is 3 times the rate prescribed by the Reserve Bank of India. |

| Initiation of Action | On receipt of an application, the Micro and Small Enterprises Facilitation Council (“MSEFC”) ordinarily initiates action within 15 days. |

| Intimation to Parties | An online intimation regarding the application is sent by the MSEFC to both the parties. |

| Mutual Settlement | The MSEFC will attempt to achieve a mutual settlement between the disputing parties by conducting conciliation between the disputing parties. |

| Arbitration | If the conciliation is unsuccessful, the MSEFC will convert the application into a complaint and conduct arbitration for adjudicating the dispute. |

| Intimation to Parties | Intimation regarding conversion of the application into a complaint will be sent to both parties. |

| Timeline | All complaints are required to be resolved within 90 days from the date of reference to the MSEFC. |

| Appeal | A buyer / service receiver is required to deposit with the relevant court, 75% of the sum awarded under the arbitration proceedings, before making any appeal against the arbitration award. |

Remedies under the Insolvency and Bankruptcy Code, 2016 (“IBC”)

An application under IBC is an effective tool to apply pressure on the defaulting party. However, in cases where the defaulting party does not make immediate repayments or more so, the insolvency application is admitted by the NCLT, large and sophisticated machinery is set in motion in form of the corporate insolvency resolution process (CIRP). The initial applicant (if an Operational Creditor) will not have much control over the process as it will be taken over by the committee of creditors and the resolution professional. At the end of the CIRP, the final amount received by the initial applicant may only be a fraction of the entire outstanding amount. Moreover, the timeline prescribed under the IBC is comparatively longer than the 90 day timeline prescribed under the MSME Act.

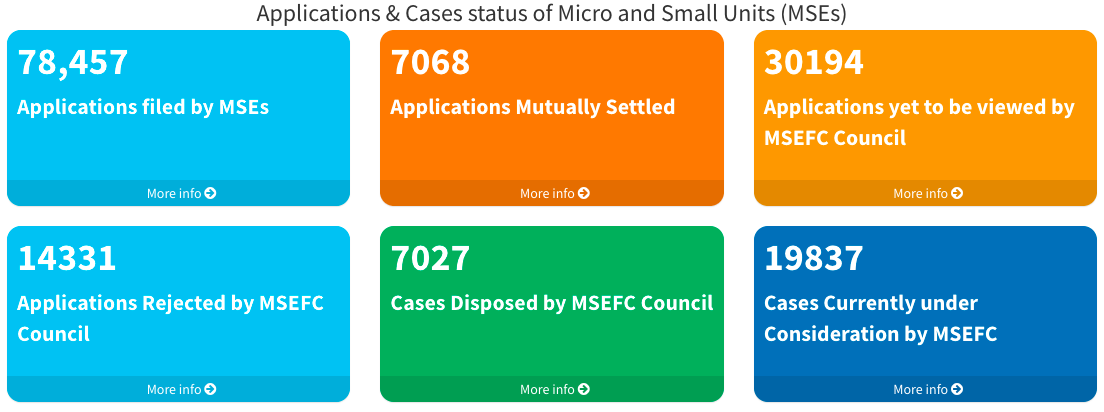

Recovery statistics as per the MSME Website

Effectiveness of recovery under the MSME Act

As evidenced by the statistics, 9% of the total applications filed have been mutually settled. A mutual settlement denotes that the aggrieved party would have atleast received an acceptable repayment of his outstanding dues. 8% of the cases have been disposed, meaning either an aggrieved applicant has received his outstanding dues or the matter was decided in the favour of the purchaser/ service recipient. Given the ease of making complaints online and the cost effectiveness of the process, the odds seem encouraging.

In the 21-22 Union Budget, along with announcing number of steps taken to support MSMEs, the Finance Minister made a provision of INR 15,700 Crores for the benefit of MSMEs, this amount is more than double the provision made in the previous budget. This shows the importance accorded to MSMEs by the Government, which makes us believe that the aforesaid statistics would only improve in the future.

For more information on obtaining a MSME registration or initiating recovery proceedings through the MSME Samadhaan Portal write to us at solutions@bridgeheadlaw.com.

- Karan Narvekar | Partner

- Maitri Malde | Trainee Associate